What’s Mission Critical for Today’s Carbon Markets?

Why High Quality Supply Should Be the Priority

Why High Quality Supply Should Be the Priority

Several high-profile projects are leveraging the Web3 tech stack to address inefficiencies in the carbon markets, but the integrity of these markets is only as robust as their supply. Facilitating transactions and building financial products before ensuring quality in the underlying asset does not solve the markets’ entrenched quality concerns. We believe improving supply quality is the most pressing need if carbon markets are to serve as a meaningful lever for decarbonization.

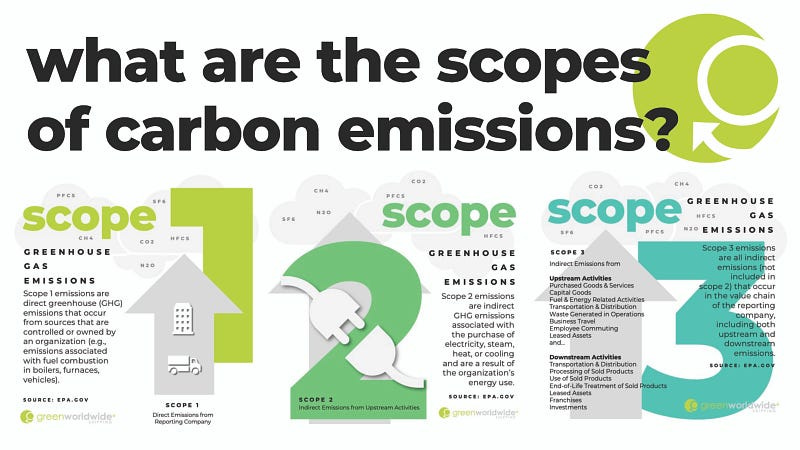

In March, the SEC proposed long-awaited climate disclosure regulation that would require companies to publish their material exposure to climate risks and any associated impacts to their business. The rules contain provisions for gross Scope 1 & 2 emissions disclosures as well as Scope 3 if deemed material or included in the company’s stated sustainability commitments. Importantly, the proposal also stipulates detailed REC and carbon offset disclosure requirements including quantity of CO2 claimed, sourcing, underlying project details, registration, 3rd-party verification, and cost. We welcome this move from the SEC as a signal that US regulators are beginning to consider climate risk as part and parcel of the financial system, and recognize the role offsets will play in corporate climate action for the foreseeable future.

Climate risk is financial risk: regulatory emphasis on corporate disclosure is crucial because we believe that public companies not directly addressing climate risks will underperform in the long term. The C-suite is voting with their balance sheets, as corporate commitments have driven demand for offsets in the voluntary markets. Visibility into offsetting activity empowers shareholders and employees to pressure public companies to improve the quality of their procurements. Regulated disclosure requirements will grow nascent carbon accounting companies like Planet FWD — one of our newest portfolio companies — whose Scope 3 emissions platform helps brands measure and manage their emissions at the product level. Scope 3 emissions typically account for the majority of a company’s footprint and yet are the most difficult to measure and mitigate over time; emissions reductions efforts at this level create ripple effects throughout supply chains. As regulations tighten and pressure from stakeholders mounts, we expect improved accounting capabilities will facilitate both reductions in operational emissions and more targeted offset procurements.

Corporate demand also drives and shapes new supply. In a welcome approach, some of the largest, most sophisticated buyers in the market recently penned Advance Market Commitments to the tune of $925m from Frontier (led by Stripe, Alphabet, Shopify, Meta, and McKinsey) and $10B by 2030 from First Movers Coalition, indicating a consensus that large capital outlays from early adopters are required to both scale up and bring down the cost of carbon removal and other crucial but nascent decarbonization technologies. Yet these commitments are orders of magnitude lower on a CO2e basis than what is needed to avoid an undesirable overshoot of 1.5°C. We need far more supply, and that supply — of both removals and avoided emissions — must be verified, additional, and durable.

As climate investors, we take the optimistic view of technology’s role in addressing the climate challenge. However, overemphasizing the importance of transactive infrastructure before supply has meaningfully evolved seems like putting the cart before the horse. The influx of startup and venture activity into this last category is cause for concern given the state of the voluntary markets. To be sure, transparency and liquidity — rather the lack thereof — along with double-counting and impermanence are legitimate problems that must be addressed for the healthy functioning of carbon markets in the long term. However, as recent analyses demonstrate, high-profile projects designed to rectify these issues have fallen notably short of the task; instead of increasing the quality of supply, they have actively induced the addition of lower-quality credits to the market. The philosophical promise of Web3 projects is not without merit, but financialization does not directly address the most pressing barrier to success for the carbon markets: high quality credits are scarce, and existing modes of evaluating quality leave something to be desired.

In our ongoing effort to focus on supply, we made our first direct foray into carbon markets when we invested in Evergrow in Q4 of last year on the thesis that carbon markets were supply-constrained due to a lack of access to traditional project financing. While our thesis continues to evolve, we believe supply-side efforts will yield the most impactful results where aligning markets with climate impact is concerned. We are encouraged to be tracking an ever-increasing pace of company formation focused on these challenges. Project origination and financing, low cost technology approaches to carbon removal, credit quality assessment, and MR&V are just a few areas where concerted investment could move the needle, and we look forward to meeting more founders directly tackling these challenges.

Nicholas Adeyi is an Investment Analyst at Congruent Ventures, an early stage venture firm founded in 2017 that partners with companies in the climate and sustainable technology ecosystem.